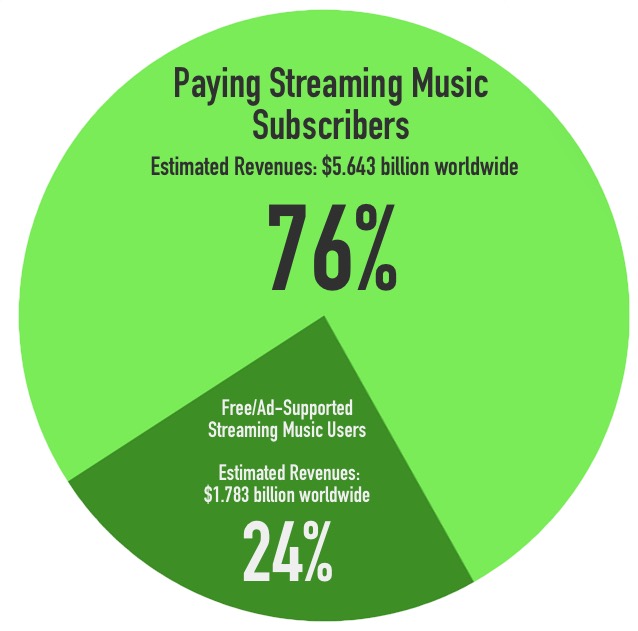

Exhibit A: Estimated number of paying streaming music subscribers vs. ad-supported free users (Worldwide, 2015).

Exhibit B: Estimated revenues created by paying streaming subscribers vs. ad-supported free users (Worldwide, 2015).

Last week, the Recording Industry Association of America (RIAA) reaffirmed that vinyl records are generating more revenue than free, ad-supported streaming users. But that is less of a reflection on how much money vinyl is making, a more a reflection of just how little money ad-supported music streaming actually generates.

These are just estimates, though despite a free, ad-supported streaming music crowd that accounts for approximately 94% of all music streaming users worldwide, the revenues generated by that mass is just 24% of the on-demand streaming music pie (internet radio isn’t included in this analysis).

Based on a running estimate of approximately 50 million, full-paying streaming music subscribers worldwide (with Spotify now contributing 30 million of those), total revenues land at roughly $5.643 billion.

The Methodology.

Here’s the breakdown on how we built these estimates:

I. Total, paying streaming music users.

In 2014, the International Federation of Phonographic Industries (IFPI) estimated a total of 41 million paying, on-demand streaming subscribers. That likely includes a number of bundled or lower-paying subscribers, though 50 million is now a ‘working average’ based on the following reports from major services:

- Spotify: 30 million paying (reported last week)

- Tidal: 1 million (last reported)

- Apple Music: 11 million (last reported)

- Deezer: approx. 3 million (based on IPO filings)

- Rhapsody: approx. 3.5 million reported (with heavy mobile bundling).

- YouTube Red: unreported (assumed near-zero in early stages)

- SoundCloud: 0 (just launched Tuesday)

Those numbers, coupled with a few others, brings the working total of paying subscribers to roughly 50 million.

II. Revenues from paying subscribers.

In its 2015 report this month, the Recording Industry Association of America (RIAA) estimated revenues of approximately $1.219 billion based on an average paid subscriber base of 10.8 million (averaged over the year). Extrapolate that to 50 million, and the revenue figure moves to $5.643 billion.

III. Estimated free streaming users.

This is a bit tricky, and relies on some liberal assumptions, but:

- YouTube: 1 billion estimated users, with an estimated 40+% of content involving music or music videos (depending on the research report). A loose estimate of the total users accessing music content is about 500 million (or 50%).

- Spotify: estimated 70 million free users (picking apart public statements from Spotify executives)

- Tidal, Apple Music: effectively 0 free users (ignoring trial users)

- SoundCloud: self-reported 175 million active free users (and currently, 0 paid on the consumer side).

The revenues from free streaming users are based on RIAA figures of $385.1 million for 2015, using the same worldwide extrapolation for worldwide premium revenues.

The post The Difference Between Music Fans That Pay, and Music Fans That Don’t appeared first on Digital Music News.