[UPDATED] With more music consumers shifting to online listening, the advertising revenue brought in by broadcast radio is a potential gold mine for digital ad-supported streaming services.

______________________________

Guest post by Glenn Peoples, Music Insights and Analytics at Pandora, from Medium

- AM/FM radio has 176 billion listening hours each year in the U.S.

- The U.S. radio market is worth $15 to $17 billion annually.

- The average American listens to 2 hours of AM/FM radio and just 36 minutes of streaming services each day.

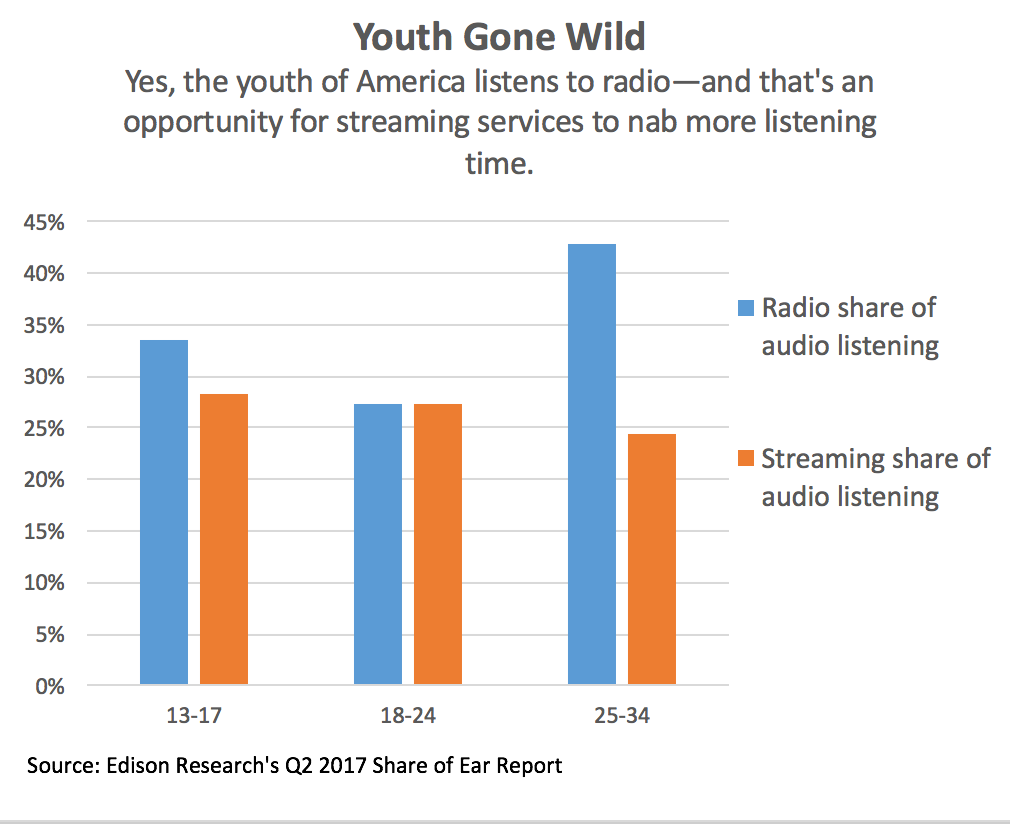

- The youngest Americans are embracing streaming services, but they have hardly deserted AM/FM radio.

After being the only game in town for decades, broadcast radio is now battling Internet services that offer better features and vastly different listening experiences. The broadcast (AM/FM) market — not in spite of its size, but because of its size — represents an excellent growth opportunity for any streaming service looking for listening hours and advertising revenue.

If you read no further, know the AM/FM radio market has about 176 billion listening hours annually and a value of $15 to $17 billion. The invention of Guglielmo Marconi casts a large shadow on its competitors. Streaming services of any source — Pandora is just one—command an average of 36 minutes of audio listening in a single day. In contrast, AM/FM accounts for about two hours.

One can’t help but think of the Northern California gold rush that spanned 1848 to 1855. Hundreds of thousands of Americans moved west in search of gold, San Francisco turned into a boom town, and Levi Strauss & Co. became a successful dry goods business before patenting a new type of denim jeans. Today‘s music market is like a gold rush, too. Over the last 15 years, dozens of music streaming services rushed into digital music to seek riches in the world’s largest market. Most of these services have gone bust, but many better, stronger companies are left, constantly innovating while competing for Americans’ ears.

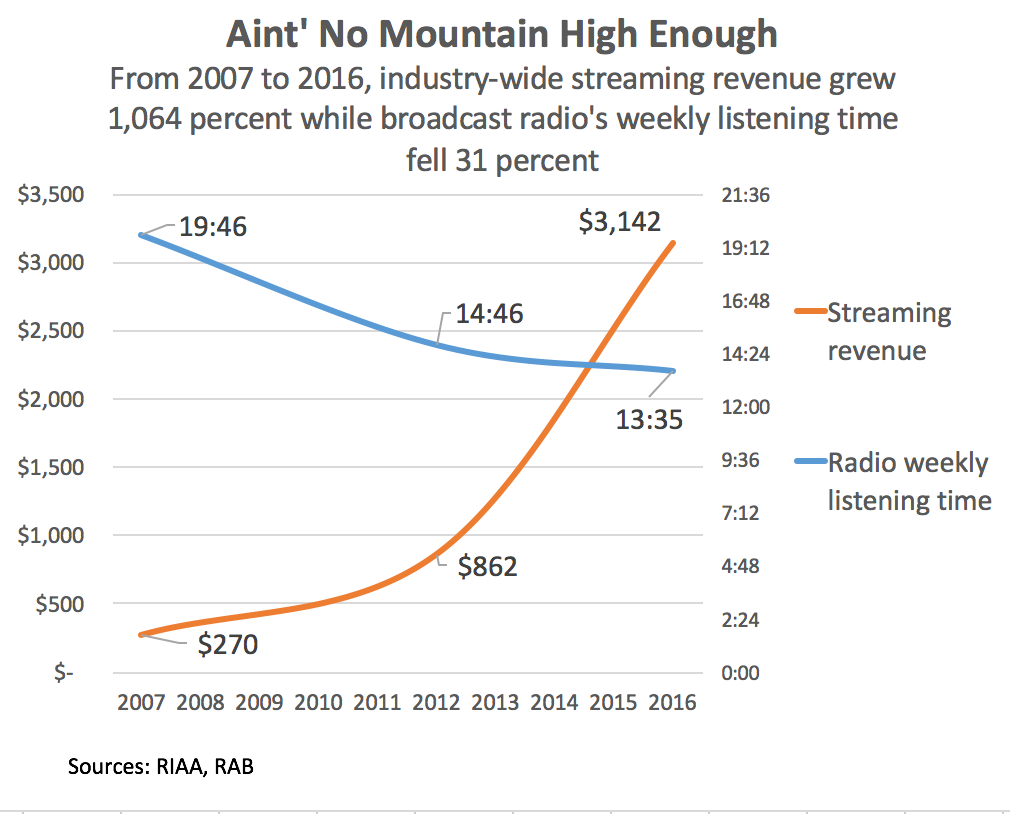

Although streaming revenue has grown bountifully in the last decade, it’s still far smaller than broadcast radio, a huge, influential, and valuable market that represents a good chunk of the United States’ $183 billion advertising business. “The radio advertising market continues to be significant at approximately $15 billion to $17 billion,” noted Naveen Chopra, chief financial officer, and interim chief executive officer, in Pandora’s July 31st earnings call.

The U.S. broadcast radio’s value, roughly the size of the global recorded music business, comes from 243 million monthly U.S. listeners 12 and older who listen for about 176 billion hours a year, a Pandora estimate gleaned from Nielsen data from Q4 2016. This is the AM/FM universe to ponder when thinking of the future of music.

AM/FM radio accounts for half of the four hours of audio the average American hears per day. And why wouldn’t it dominate? It had a big head start. The first radio program broadcast is said to have taken place on Christmas Eve, 1906, when Reginald Fessenden, the engineer who brought speaking to radio waves, broadcast himself playing “O Holy Night” and reading Bible passages. Broadcast radio advertising also has a decades-long head start over online advertising. The seller of apartment buildings in Queens, New York, purchased the first advertisement on the airwaves, from New York’s WEAF in 1922 — that’s 83 years before Pandora’s launch!

Today, spins on streaming services are becoming the new radio spins, often giving tracks their initial momentum before getting played on broadcast radio. In fact, record label promoters take streaming data to a station’s program directors as evidence of a songs’ popularity. “Look at these spins,” a promoter might say. “People in your market love this song.” Streaming is a sort of new radio. Pandora makes available all types of music that get little to no broadcast radio play. It has 16 metal stations; 16 of classical; 30 of reggae; 19 for folk and singer-songwriters; 37 for world music spanning countries and continents; 23 of jazz; and four exclusively for bluegrass! That type of personalization, born from the one-to-one nature of streaming, available to any listener at any time, cannot be matched by a one-to-many, over-the-air broadcast station.

There’s more potential than might meet the eye. Music is usually depicted as a like-for-like competition. That is to say, one streaming company does battle with other streaming companies, and one radio network does battle with other radio networks. But any person’s audio listening comes from a variety of sources: AM/FM radio, streaming, satellite radio, TV music, podcasts, and owned music like CDs and MP3s. Streaming isn’t a zero-sum game. Streaming hours aren’t the only goal. AM/FM listening hours are the larger goal. Digital services might be competing against one another, but at the same time, they’re fighting for the listening hours of heavily entrenched, AM/FM companies. Streaming is a substitute — definitely at home, increasingly in the car — for AM/FM and its 176 billion annual listening hours. The more consumers see streaming as a replacement for broadcast radio, and the better the listening experiences, the more revenue and listening time will shift from the older technology to the newer one.

Young listeners typify the opportunity at hand. Contrary to popular wisdom, the youth of America still make AM/FM a major source of listening. According to Edison Research, for the 13–17 demo, the young end of Generation Z, radio accounts for 34 percent of audio listening. The 18–24 age group, the older end of Generation Z, puts 27 percent of audio listening to AM/FM. Millennials age 25 to 34 are heavier AM/FM listeners with a 43-percent share. These numbers aren’t the failure of streaming services as much as the continued attractiveness of AM/FM radio. Pandora and other streaming services should regard youth’s interest in AM/FM as an opportunity.

Pandora’s ability to steal away AM/FM hours is the essence of the Internet’s ability to disrupt legacy markets. Before streaming, recorded music had already gone through one upheaval in the young century. The compact disc reached its pinnacle in in 2001, the tail end of the era of boy bands and deep discounts at big box retailers. iTunes launched in the U.S. in 2003 with 99-cent tracks and $9.99 albums, becoming an instant hit and establishing the market for legal downloads. Seven years later, as CD sales shrank, download sales helped digital revenue overtake physical sales for the first time. This pecking order was short-lived, however. By 2011, the digital download had peaked, and the next digital technology would begin its rise.

A tipping point came in 2016 when streaming accounted for a majority of U.S. recorded music sales— 50.3 percent to be exact — an incredible feat considering its share was just nine-percent five years earlier. (Broadcast radio is not represented in that statistic since stations are not legally required to pay royalties to record labels.) As buying music is falling out of favor, a door has opened wide for services such as Pandora to give people music how they want it: on mobile phones (most of which lack an FM antenna), on the web, in the car, through home digital systems like Sonos, and through smart speakers like Echo and Google Home. Ironically, streaming is taking music back to its roots. Just like AM/FM radio, streaming gives people access to music rather than ownership.

To understand AM/FM radio’s place in American culture is to appreciate its staying power. It’s size and influence has made it nearly ubiquitous for decades. AM/FM dominated the the airwaves before the advent of television and grew during the post-World War 2 surge in automobile sales. It considerable strengths: a wide reach, high automobile usage, and a powerful lobby in Washington DC. But it has signs of weaknesses, too. Although its future isn’t as bleak as portrayed in a recent white paper by Larry Miller, Director at the Steinhard Music Business Program at New York University, one of AM/FM’s vital metrics has declined over the last decade: average weekly listening has declined 31 percent from 19:46 minutes in 2007 to 13:35 in 2016. On one hand, radio can still boast of a 91-percent penetration rate amongst U.S. adults, a number that has more or less held steady over the years. Such a high penetration rate should be the envy of the audio world. But on the other hand, market penetration isn’t the same as listening time. That is to say, 91 percent of 13:35 is less than 91 percent of 19:46.

Small changes in listening habits will have huge after effects. A million listening hours lost by traditional radio can mean the departure of tens of millions of advertising dollars. Just ten percent of radio’s daily listening time is worth nearly 18 billion listening hours, more than enough to benefit any single streaming service. At current trends, streaming’s share of daily listening will undoubtedly increase from its current 36 minutes per day, taking some of AM/FM’s daily hours and capturing a portion of its $15 to $17 billion revenue. This value exchange isn’t just inevitable, it’s already happening. Pandora’s advertising revenue has grown to $1.09 billion in the last four quarters (ended June 30). Attracting radio dollars has been a key part of the company’s strategy. To get radio dollars, a streaming company needs to behave like radio company. So, four years ago, using measurement data by Triton Digital, Pandora integrated with the Strata and MediaOcean buying platforms to tap into broadcast radio ad budgets.

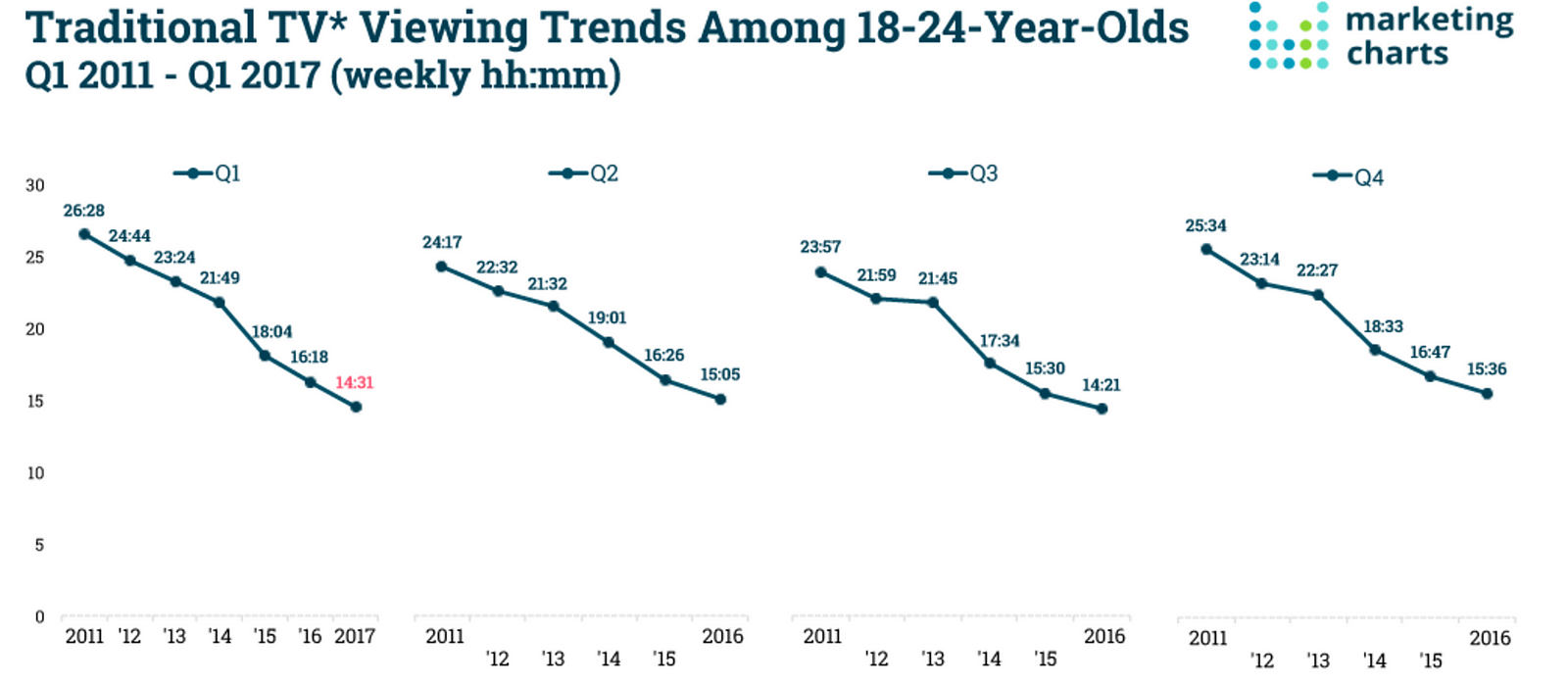

There are signs of media disruption well beyond radio.. In February, viewing with connected devices (Apple TV, Roku, Chromecast, et al.) surged 56 percent compared to the previous year, according to Nielsen. At the same time, national television have been rolling out their competing streaming packages to stem their losses and adapt to their new reality. Newspapers have struggled to produce journalism under the financial challenges of digital advertising; digital-first, global news sites have captured readerships few traditional newspapers can achieve. These are hardly surprises: entrenched players in legacy industries are usually slow to react to market trends spurred by nimbler startups. This is the state of AM/FM radio in America. Broadcast radio has ceded some of its listenership to Pandora, podcasts and other newcomers — and there are still 176 billion annual listening hours available for the taking.