As Chinese internet giant Tencent struggles with profitability and maintaining a strong stock market valuation, Spotify, which owns a significant stake in Tencent Music (and visa versa), should pay attention to avoid a similar misfortune.

_________________________

Guest post by Chris Castle of Music Tech Solutions

If you’ve ever asked yourself why Spotify has such a large market cap, I’d suggest there are a couple reasons. (One we can eliminate right away is that the company is actually worth today’s $34,880,000,000 valuation.)

We can discount as a correctable market distortion the fact that Spotify manipulated the SEC into allowing the company to take its private market sale price as an indicator of what its public shares should trade at (discounting that most of the private stock was likely sold by insiders on the private market who had an interest in propping up the valuation). We can also discount that the “direct public offering” resulted in shares being sold by insiders on the public market who had an interest in propping up the stock price and the implied valuation.

One cannot underestimate the role that Chinese darling Tencent played in the dance that was Spotify’s stock market valuation and resulted in Spotify and Tencent holding 10% of each other, Dot Bomb Style.

The only problem is that while the Peoples Republic of China can command a lot of stuff in their economy (if you can call it that), one thing Xi Jinping (who is General Secretary for Life of the Communist Party of China, President for Life of the People’s Republic of China, and Chairman for Life of the Central Military Commission) cannot control is the stock market. And the stock market is sending a signal about Tencent that Spotify would do well to pay attention to given the chunk of Spotify owned by Tencent. (Check quickly to see if any recordings of the Tibetan Freedom Concert are available on Spotify.)

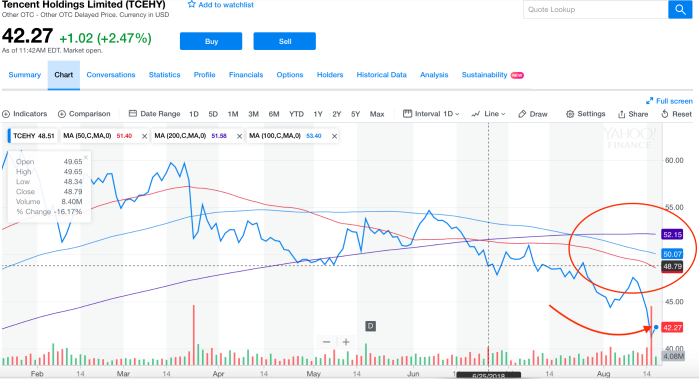

Tencent is down 17% on the year and dropped a bunch yesterday from its first profit cut in 13 years because “it did not know when it would get Chinese approval to make money from its most popular game” according to Reuters.

That’s a good reminder of the facts on the ground for Chinese companies–if President for Life Xi Xinping doesn’t want you to make money, it can ruin your whole day. Read the Tencent earnings call transcript. And a squeeze on Tencent can also create some international or regional index fund torque that affects other big Chinese companies.

But the tale of the tape tells us that the problems started for Tencent quite some time ago–in January Tencent had a $575 billion market cap compared to $403 billion today, a lopping of some $170 billion–that’s billion with a “B”–off of its market cap. Which is indicative of the problems with the Chinese economy as a whole–not to mention that there’s a lot of domestic retail investing on margin in China and short selling.

And when the margin calls come in, that stuff is nasty no matter what geographical economy you live in (see The Big Short.)

So at the moment, it looks as if Tencent’s shares of Spotify are doing better for Tencent than Spotify’s shares of Tencent are doing for Spotify.