Few failures have had a more direct impact on the indie music community than the recent demise of PledgeMusic, not only for those owed millions of dollars, but also for the many others who had come to rely on the platform for pre-sales and fundraising. In recent days, a variety of sources has accused the PledgeMusic board of being at the root of the failure. Here David Lowery takes his own critical look.

_____________________________

“Success has many fathers, failure is an orphan” – Generally attributed to Roman Senator Tacitus approximately 98 AD

To Gursh: To overstate one’s role in the success of a record or artist; or conversely, to understate one’s role in the failure of a record or artist – NY music industry slang dating from at least the early 1980s.

By musician and artists advocate David Lowery from The Trichordist. (Note: This article has not been independently verified by Hypebot.)

In the offices and boardrooms of any corporation it is not uncommon to find executives wildly overstating their role in the success of some corporate initiative, or conversely radically understating their role in a spectacular failure. It is just in the nature of homo corporaticus. It is an evolutionary tool designed to insure survival of the species.

Music industry professionals are no different. But since this is the music business we created a word for it: Gurshing. And we perfected it as an art. This is largely because the music business is built on the illusion of success. Most songs are failures. Most albums are failures. Most artists are failures. Even if you are an extremely talented producer or A&R executive your raw track record is going to suggest a success rate in the low double digits. 14% of the albums you record as a producer actually make any money? 8% of the acts you sign make money for the record label? All guesses but probably not far off. But because successful songs, artists, records make so much money the high failure rate doesn’t actual matter in the long term to producers, managers, songwriters, publishers and labels.

However, no aspiring artist or songwriter wants to be confronted with the terrible odds and sheer capriciousness of success in music industry. They don’t want to sign with an entity or individual that has a 12% success ratio. Thus the high failure rates are rarely discussed and instead we create little stories that make ourselves and our companies seem reliably successful. If you want to sign, produce or co-write with other writers you have to distort your track record. The easiest way to do that is through gurshing. If you do this artfully enough you create the appearance of continual success. Then through the magic of something called The Matthew Effect you gain access to a more talented pool of artists thus increasing the odds of your success. Eventually this virtuous cycle turns perceived success into real success. You just have to be willing to gursh like a con-artist in the beginning and then stick it out.

On the other hand, one thing you absolutely never do in the music business is purposely associate yourself with failure. This is not Silicon Valley. Failure is not fetishized. Getting tarred with a big failure can undo years of careful gurshing and reputation management.

l bring all this up because I find it fascinating to watch Benji Rogers co-founder and former president of Pledge Music rushing into the burning building that is Pledge Music. A company he left and would seem to have no apparent obligation to save. In the music business this is the type of thing you normally want to gursh away from. Benji genuinely qualifies as child of music industry royalty. His parents and stepfather were successful managers and publishers. So gurshing should be like a pavlovian reflex to him. So his behavior is not what I would have expected from some one who grew up in the music industry. Nobody in the music business steps back in to help when this kind of failure occurs.

It’s admirable in many ways. An expression of loyalty to former company, partners, employees, customers and artists. A sign of a stand up guy.

It is also totally understandable. Of all his many companies (Benji lists 8 on his LinkedIn Profile) Pledge Music is obviously the only real “hit.” He made his name with Pledge Music. It’s part of who he is.

However, I just have to say, it’s really not helpful to anyone. Not to partners, employees, customers, artists and even Benji Rogers himself. Yes, it’s complicated It always is. But let’s start with the most obvious reason it’s unhelpful. It muddies the story. It seems to be a distraction, unintentional, but still a distraction from the fact Pledge Music’s purportedmajority shareholder Joshua Sason, is the guy named first in the SEC complaint below.

(The other defendants Sharma and Salviola have an interesting history See here, here, hereand here. Also named is the fabulously named Zirk de Maison. He is also an interesting person: see here.)

Now this complaint doesn’t directly have anything to do with Pledge Music, but it is certainly part of the story. The majority shareholder of a company running out of money gets an SEC complaint for what appears to be a fraud perpetrated by his other company? C’mon! Anyone associated with Pledge pretending like it’s not part of the story? Well, that makes it part of the story.

If you read the complaint it alleges pretty crazy stuff. From the SEC press release that goes with the complaint:

“According to the SEC’s complaint, from approximately December 2012 to June 2013, microcap stock financier Magna Group, which was founded and owned by Joshua Sason, engaged in a scheme to acquire fake convertible promissory notes supposedly issued by penny stock issuer Lustros Inc. and then to convert those notes into shares of Lustros common stock. The defendants then sold the shares to unsuspecting retail investors, who did not know that the shares were fraudulently acquired and were being sold illegally. The defendants’ sales of the Lustros shares also had the effect of destroying the value of the Lustros shares held by the public.”

So this guy didn’t get charged because he forgot to file a form, or checked the wrong box. According to the SEC he is charged with violations usually associated with con men. And according to the SEC he didn’t do it just once:

“The complaint also alleges that in November 2013, Magna Equities II, which was also wholly-owned by Sason, and Manuel, purchased another fake promissory note from Pallas Holdings. Magna Equities II and the note’s issuer, NewLead Holdings, Ltd., later agreed to retire the fake debt in exchange for shares of the issuer through a court-approved settlement agreement. To obtain approval of the settlement, Sason and Magna Equities II falsely swore to the court that the fake promissory note was a bona fide debt of NewLead. Kautilya “Tony” Sharma and Perian Salviola, who controlled Pallas Holdings, are alleged to also have participated in the scheme.”

It was shortly after this Sason reportedly invested 3 million in Pledge Music. And that’s another reason why this should be part of the story. If true did some of that 3 million come from the alleged fraud? According to Billboard

“Sason, 31, has been member of the PledgeMusic board of directors since 2014. That same year, Magna reportedly invested $3 million into PledgeMusic and Magna Entertainment vice president Russell Rieger — a former exec with Maverick Records and London Records, who is not being charged by the SEC — was also appointed as a director to PledgeMusic’s board.”

The weird thing about this investment is I can’t seem to find it reflected in the share tables or other documents. I could be a total idiot. But it’s not under Sason’s name or even any of his known companies (more on “known” part later). Perhaps it was a loan? Or maybe the Billboard’s source was wrong?

Similarly, according to Billboard in 2016 Sason becomes majority shareholder in Pledge Music. From Billboard Feb 19 2019:

In 2016, it was reported Magna Entertainment acquired a major position in PledgeMusic, but deal terms were not publicly announced. Sason is currently the only director listed as a person with significant control in PledgeMusic, according to the U.K.’s Company’s House.

But again, I don’t see shares going to Sason or one of his known companies. If you want to check, look here. Maybe Billboard source is wrong. Or I’m a total idiot. (Leave comment if you find something i missed).

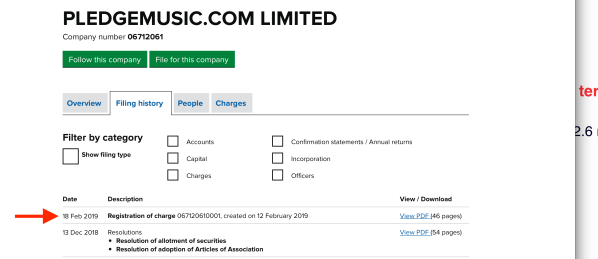

It does seem that UK corporate authority (Companies House) has flagged Pledge Music for missing documents and accounts. See screenshot above. Perhaps that’s where one will find the transfer of shares?

Around this time Sason’s Vice President at Magna Entertainment (a different company than the one named in the SEC case, but still owned by Sason) becomes GM of Pledge Music.

This last bit is fairly normal stuff. New owners new people in. Until you step back and look at the big picture. Digital Music news, Bloomberg and other publications have noted Sason made his fortune lending money to failing companies and then obtaining big discounts on shares. There is no evidence Sason did this with Pledge. And there is nothing necessarily illegal even if he did (as long as board approved). The 2016 deal terms that gave Sason control of company were not announced, there are no clues in available company documents but something like this could have happened.

Also phrasing in the Billboard story is curious: “acquired a major position.” Not “purchased a majority share.” Then again it could mean absolutely nothing. No one knows or will know until a creditors list is released in bankruptcy proceedings.

So who might those creditors be?

Well there is one clue listed in company documents. In Feb 2019 after the company was clearly in deep financial trouble this loan facility was activated. (Agreement originally entered into Sept 2015 about the time Sason reportedly took control of the company, but loan was not activated.)

So who are the lenders?

PledgeMusic.com is borrower, but another arm of the company a “Special Purpose Vehicle” PledgeMusic SPV is the lender. As well as a Panamanian Company called Beacon Assets Holdings Limited BVP I LLC. Another board member David Rowe through his bank (Sword and Rowe) is the Collateral Agent. Collateral Agent is generally a neutral party. But does not have to be. In this case it is not.

As our sister publication Artist Rights Watch reports:

“So I found that reference to be a little odd for a company that was scraping by on 15% of artist campaigns. What was even stranger was the date of the loan: February 12, 2019.

What was PledgeMusic doing borrowing money in February, mere weeks before it went into ‘administration’ in the UK–roughly the equivalent of bankruptcy? Who–besides the shylocks–would loan them money?”

So a subsidiary of Pledge Music is loaning money to itself. Right before bankruptcy. And collateral agent is one of the board members. This just all seems so odd. It’s a very complicated way to do business.

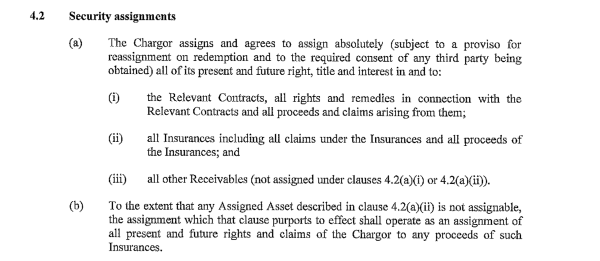

Further it appears the document allows the creditors PledgeMusic SPV and Beacon Assets Holdings to effectively take control of the checking accounts which may or may not hold artists’ co-mingled funds. As Artists Rights Watch reports:

“This may be important if, as has been reported, Pledge failed to maintain a separate escrow account for the artists’ pledges and simply co-mingled all of Pledge’s money with the artists’ money.

But follow the next step: By using the SPV method, it is possible that Pledge might try to extract the money from its own accounts to repay the loan that it made to itself (along with the other lenders in the syndicate) by foreclosing its security interest on its own bank accounts in which it co-mingled funds.”

The Artists Rights Watch article goes into great detail and anyone interested should read the whole thing. It’s a remarkable piece of detective work. But there’s more.

I also want to note that there is another unusual thing here. I am not an expert, and I may be reading this wrong but it looks like in the same document the loan syndicate (Pledge SPV and Beacon Assets Holdings) also effectively takes control of insurance payouts. See above. Or here. I don’t know if the company has liability insurance for it’s directors in the case of say a class action lawsuit. But this document looks like this would give the loan syndicate first dibs on the payout. So is it possible the board members will have to personally pay out of pocket in the event they have some liability? If my reading is correct this is really weird. Is this like a poison pill to discourage a class action? Does this arrangement leave someone else holding the bag in the event there is some liability to directors? I caution, I could also be reading this wrong. It’s a very long and complicated document.

Regardless, if I were Don Ienner and David Walsh I would be getting very very nervous right now. I’d wanna make sure I was covered by some sort of insurance. Everyone else on board looks like they already have bigger problems or are on other side of the loan.

And what about this other company Beacon Assets Holdings?

Beacon Assets Holdings appears in the ICIJ so called “Panama Papers” database. It’s essentially an offshore shell company of some kind. There is nothing necessarily illegal about this. There are plenty of non-illegal reasons for investors to protect their assets (and privacy) in this manner. In fact let me just reprint the ICIJ disclaimer here:

“There are legitimate uses for offshore companies and trusts. We do not intend to suggest or imply that any people, companies or other entities included in the ICIJ Offshore Leaks Database have broken the law or otherwise acted improperly. Many people and entities have the same or similar names. We suggest you confirm the identities of any individuals or entities located in the database based on addresses or other identifiable information. If you find an error in the database please get in touch with us.”

I reiterate. Just because a company is in this database doesn’t mean they are doing something illegal.

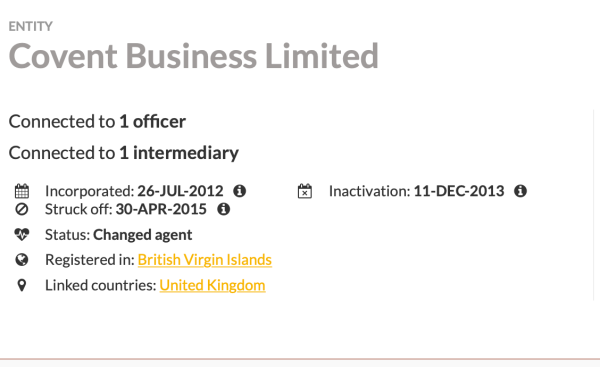

However, Beacon Assets Holding appears to have a single shareholder, Covent Business Limited of British Virgin Islands.

This company (Covent Business LTD) was incorporated July 26th 2012 and then became inactive less than 18 months later. The British Virgin Islands appears to have “struck off” the company in 2015. Basically this company has been dissolved. Could mean nothing at all. Perhaps the owner decided they didn’t need this company for a host of reasons.

So this looks to be a timeless story. An idealistic entrepreneur starts a company to help musicians and artists. The company has to borrow money along the way. The creditors eventually take control of the company and either through incompetence or in an attempt to make a fast buck run it into the ground. I really don’t know what happened. All I’m saying is this story is much weirder and more complex than it seemed at first.

But there is more to tell. I’ll explore this further in part II.